Last Mile Credit Linkage to Strengthen Rural Livelihood

by Arkajyoti Patra

9th June, 2021

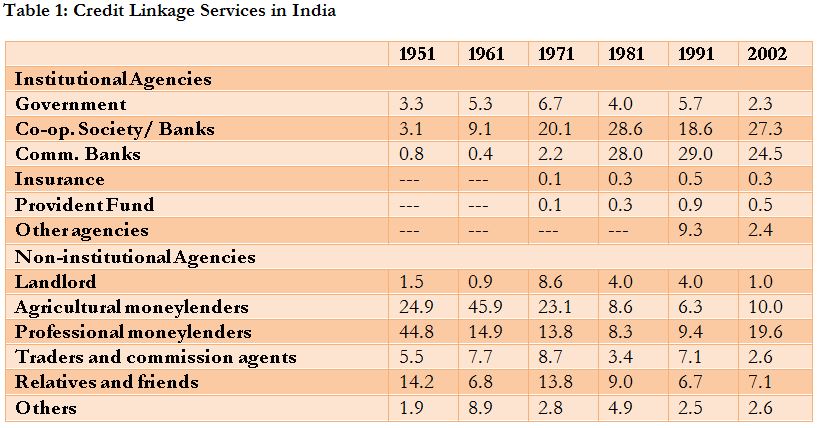

Rural credit markets in India comprise of both formal and informal channels. Though the market is fragmented, many approach informal channels for their credit requirements. The most common source of credit in the villages of Koraput&Nabarangpur is from moneylenders, aka Sahukaars. These moneylenders charge around 60% to 120% interest annually. Although the share of informal credit has dropped drastically, it still accounts to almost half of all credit linkage services in the country as shown in Table 1 below;

Rural credit markets in India comprise of both formal and informal channels. Though the market is fragmented, many approach informal channels for their credit requirements. The most common source of credit in the villages of Koraput&Nabarangpur is from moneylenders, aka Sahukaars. These moneylenders charge around 60% to 120% interest annually. Although the share of informal credit has dropped drastically, it still accounts to almost half of all credit linkage services in the country as shown in Table 1 below;

Credit Linkage through Village Level Institutions

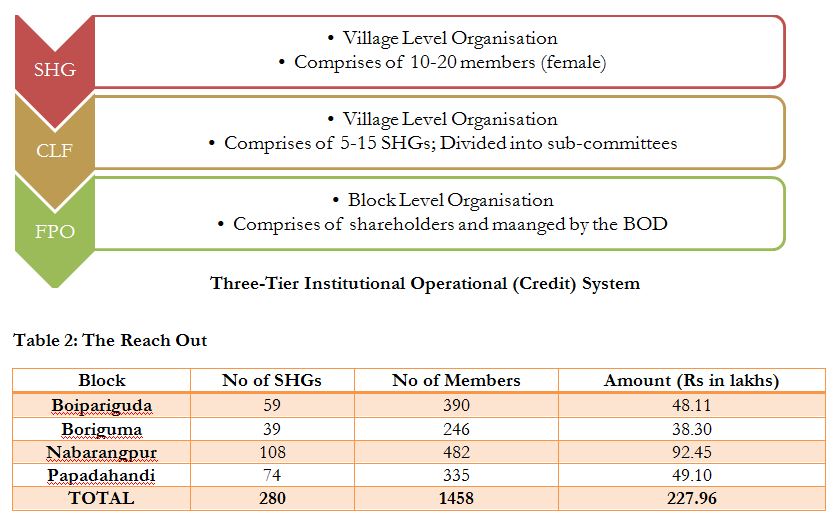

Harsha Trust has partnered with Rangde during the first wave of Covid-19 in India in 2020 to provide credit access to rural communities, especially women shareholders of Farmer Producer Organisations (FPOs) for agriculture and livestock rearing. The credit linkages are primarily facilitated for crops like Paddy, Maize, Sugarcane, Vegetables& Goat/Poultry rearing. Prior to any processing of application, Harsha Trust adopted a mandatory Three-Tier Institutional Operational (Credit) System; 1) At SHG level to which the shareholder belongs to, 2) At VO or CLF level to which the SHG belongs to and 3) At FPO level, the Board of Directors will review & approve the application. The loans are provided to the shareholders at zero percent interest while Harsha Trust ensures RangDe of full recovery of the amount. A thorough counseling of all interested shareholders is done prior to providing them credit to determine the activity/ asset they are likely to invest in and the profit they are expecting to get at the end of the cycle.After thorough verification all required documents are uploaded to the Rangde portal.Second round of verification of the applications is done by Rangdeafter which the amount is disburse to the applicants account.

Harsha Trust supported FPOs have reached out to 280 SHGs helping 1458 women across 4 blocks of Koraput and Nabarangpur in accessing timely credit during the Kharif and Rabi of 2020 disbursing a total amount of Rs. 2.28 crores. The loan repayment rate has been 98% and in the meanwhile the FPOs have generated Rs. 16.7 lakhs as facilitation cost in FY 2020-21. FPOs have submitted a declaration at RangDe for repayment of the loan credited to their shareholders. So the teams at Harsha Trust & FPOs are engaged in a credible image establishment & breaking a traditional approach to defaulter/Non Credible RuralPoor in regards to credit management.

Case of Sabita Jena

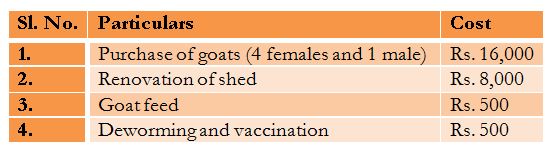

Patneswari Agricultural Producer Co. Ltd. (PAPCL) with support from Harsha Trust partnered with Rangde to give credit access to its shareholders for agriculture and livestock rearing and/or other business activities. Sabita Jena is one such twenty-four year old beneficiary who lives with her mother in the village of R. Maliguda. Abandoned by her father, she is the sole earning member in the family. She works as a Community Resource Person in some government and non-government organizations to make ends meet. Though the family is also involved in agriculture and livestock rearing as well but due to lack of timely credit at a reasonable interest rate they refrained from investing into them beyond their available financial means. When PAPCL approached the shareholders from R. Maliguda to provide credit linkage, only three were selected by Rangde based on their credit history, Sabita being one of them. She applied for a loan of Rs. 20,000 for goat rearing. The estimated cost division for the same is shown in Table 2 below.

Outcomes and Results

- Sabita has purchased four female goats at Rs. 2,500 each and a buck for Rs. 6,000 from the local market.

- She has renovated and increased the capacity of the shed to accommodate the new goats that she purchased.

- Initially Harsha Trust provided her with goat feed which improved the health of the animals. Observing this she purchased more feed from the market at Rs. 30/ kg.

- She ensured that a timely deworming and vaccination cycle is maintained which reduced the mortality to zero in the year 2020.

- As of June, 2021 she has 4 doelings and 2 bucklings alongside five does and a buck which she owned previously.

Conclusion

Many people in rural India still do not have access to timely credit at a reasonable interest rate. Their trust in MFIs has been shaken given their experience with these companies, which makes them less eager to take loans from formal channels. Banks also lengthen the process of disbursing the loans to the villagers and also hesitate to give credit support to them without any mortgage as they are considered to be negative profiles. However, if village level organizations like FPOs can be capacitated to provide credit linkage, it might overtime be able to replace informal channels if it continues to provide credit after a thorough cost benefit analysis of the models so as to avoid incurring any losses, both on the institution and on the people's part. Harsha Trust aims to capacitate the FPOs to reach out to 2150 women and disburse Rs. 4.5 Crores in FY 2021-22.